long island tax calculator

To learn more call 631-761-6755. After a few seconds you will be provided with a full breakdown of the tax you are paying.

New York Property Tax Calculator 2020 Empire Center For Public Policy

The New York state sales tax rate is currently 4.

. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Capital gains tax rate on collectibles. Long Island Nassau Nassau unveils school tax calculator.

And married filing jointly 25900. The Long Island City sales tax rate is. The New York sales tax rate is currently.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Capital gains tax rate for unrecaptured Sec. May 15 2013 Credit.

To use our New York Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. If you make 55000 a year living in the region of New York USA you will be taxed 12213That means that your net pay will be 42787 per year or 3566 per month. What is the sales tax rate in Long Island City New York.

You would pay capital gains on that 300000 increase in property value at a 20 tax rate. However effective tax rates in the county are actually somewhat lower than that. Get Your Max Refund Today.

The minimum combined 2022 sales tax rate for Long Island City New York is. This is the total of state and county sales tax rates. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

This is the total of state county and city sales tax rates. There is also a supplemental withholding rate of 1170 for bonuses and commissions. Maximum capital gains tax rate for taxpayers with income above 445850 for single filers 501600 for married filing jointly.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Heres how the tax works. The County sales tax rate is.

Married filing separately 12950. The first 150000 of the purchase price of improved land in Riverhead and Southold and the first 250000 in East Hampton Southampton and Shelter Island is exempt from the tax. Rules of Procedure PDF Information for Property Owners.

The new top rate would apply only to people earning over 1 million per year. Sales taxes for a city or county in New York can be as high as 475 meaning you could potentially pay a total of 875 sales tax for a vehicle in. The 2018 United States Supreme Court decision in South Dakota v.

Nassau County lies just east of New York City on Long Island. For tax preparation accounting services in Suffolk County visit Weisman CPA the most trusted Long Island CPA firm. New York has a 4 statewide sales tax rate but also has 988 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4229 on top.

Your average tax rate is 222 and your marginal tax rate is 361This marginal tax rate means that your immediate additional income will be taxed at this rate. But under Bidens tax plan individual long-term gains would increase from a 20 rate to a maximum rate of 396 on ordinary income. How to Challenge Your Assessment.

Freedom Land Title Agency is an authorized title agent providing title insurance and related services to the real estate and banking community throughout the United States. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Calculate your New York net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New York paycheck calculator.

The state as a whole has a progressive income tax that ranges from 4 to 109 depending on an employees income level. This calculator is designed to help you estimate your annual federal income tax liability. Biden tax plan and real estate.

Switch to New York hourly calculator. Nassau County Tax Lien Sale. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to New York local counties cities and special taxation districts.

New York Payroll Taxes. An image of Nassau Countys new online school district tax estimator. Has impacted many state nexus laws and.

Heads of household 19400. New York Salary Paycheck Calculator. For the 2022 tax year the standard deductions are as follows.

The exemptions are 75000100000 for vacant land. The minimum combined 2022 sales tax rate for Nassau County New York is 863. Calculating taxes in New York is a little trickier than in other states.

The Nassau County sales tax rate is 425. Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes. In 2018 the average millage rate in the county was 264 mills which would mean annual taxes of 7920 on a 300000 home.

Assessment Challenge Forms Instructions. Your household income location filing status and number of personal exemptions. Did South Dakota v.

Cryptocurrency Taxes What To Know For 2021 Money

Capital Gains Tax Calculator 2022 Casaplorer

Tax Preparation Tax Services For Businesses In Long Island Tax Services Business Tax Tax Preparation

New York Paycheck Calculator Smartasset

Taxman Tightens Reporting Norms For Mncs Mortgage Loan Calculator Paying Off Credit Cards Mortgage Payoff

Bankruptcy Attorney New York Nassau Suffolk County Of Long Island Accounting Firms Accounting Services Tax Season

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Kingston Property Tax 2021 Calculator Rates Wowa Ca

Amelia Grant Small Business Accounting Software Business Accounting Software Small Business Accounting

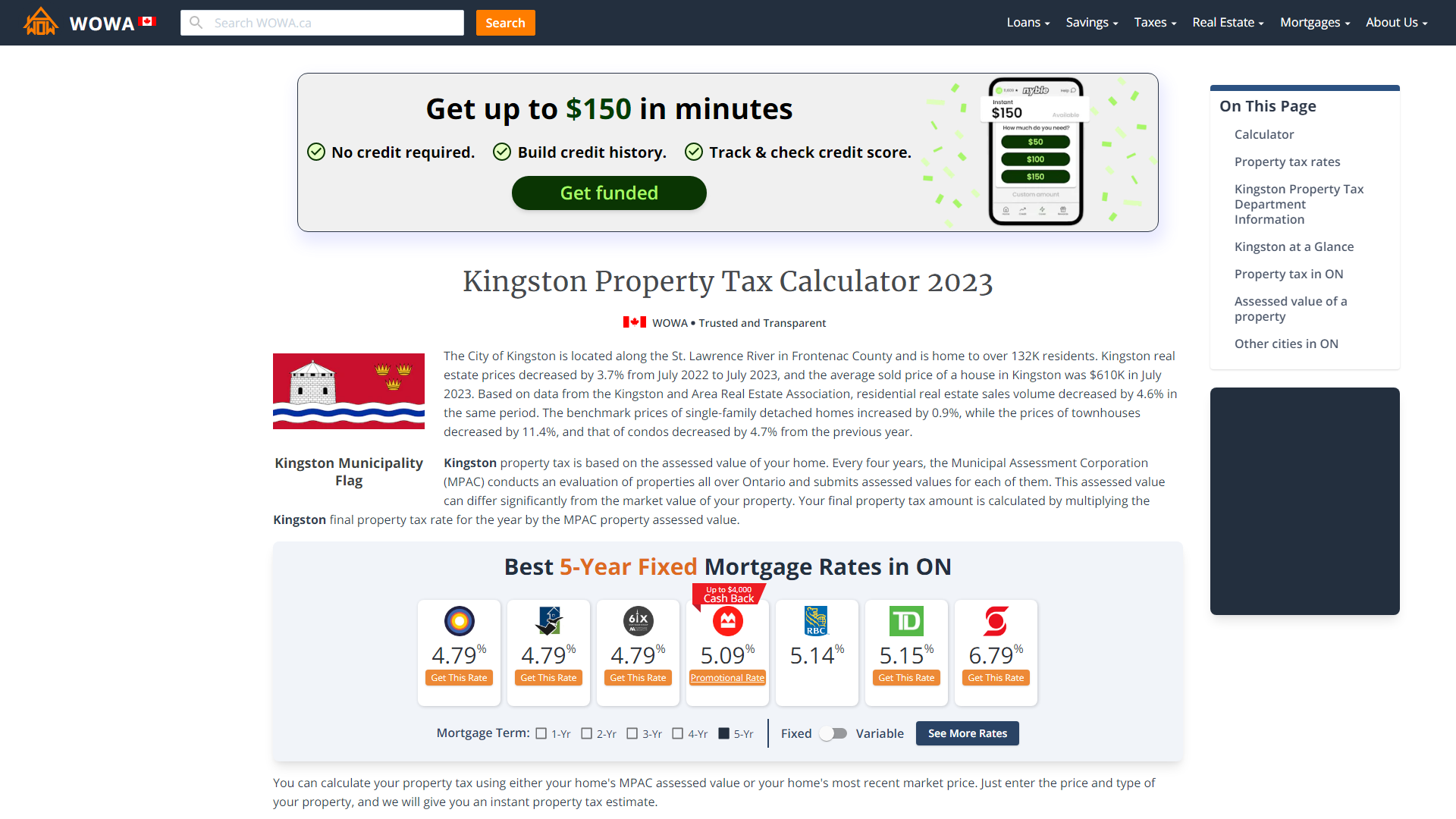

Ontario Hst Calculator 2020 Hstcalculator Ca

Quebec Land Transfer Tax Welcome Tax Wowa Ca

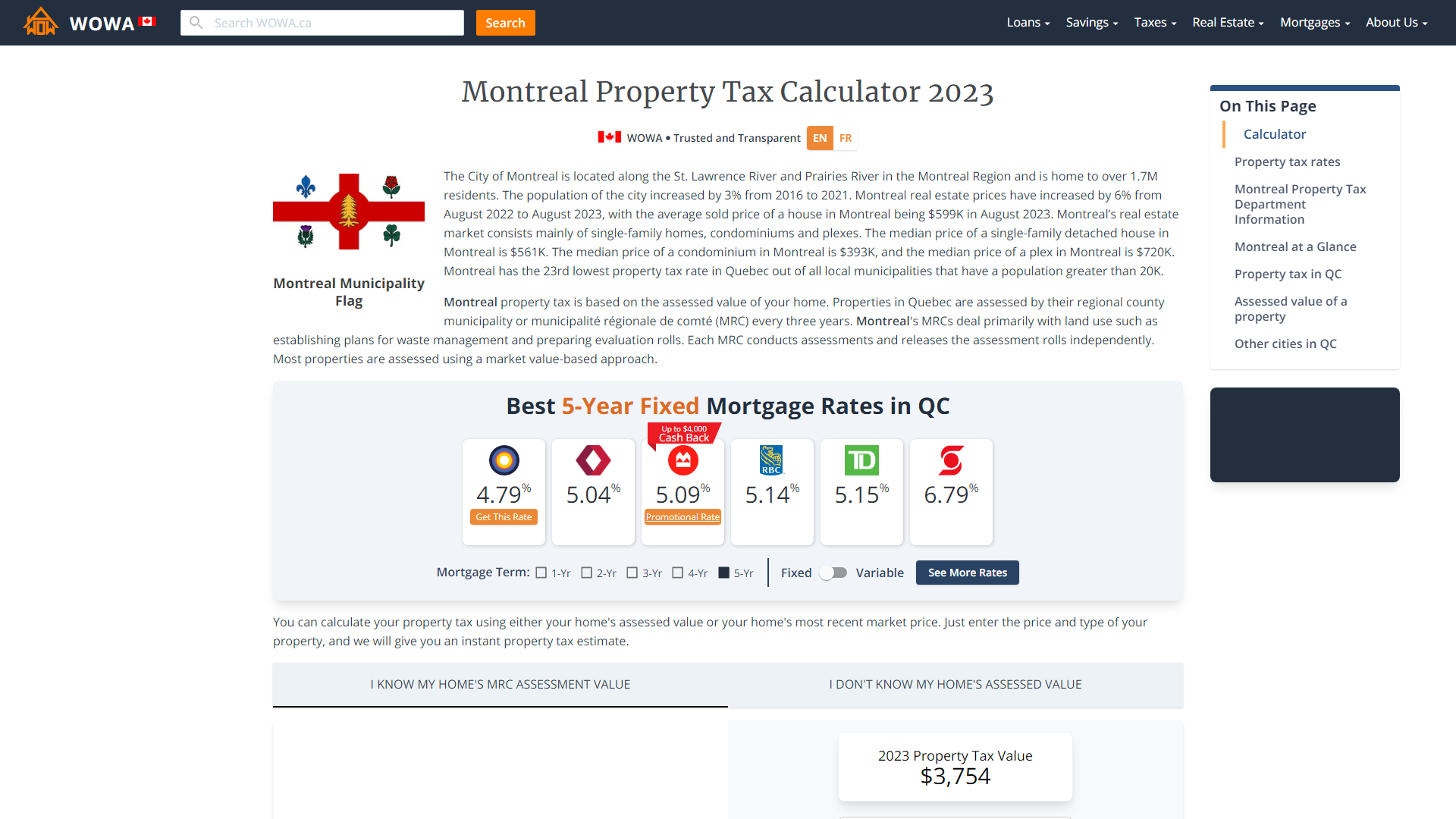

Montreal Property Tax 2021 Calculator Rates Wowa Ca

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Nyc Mansion Tax Calculator For Buyers Interactive Hauseit

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Traditional Vs Roth Ira Which Is Better Roth Ira Money Management Investing Strategy